Mapquest, Friendster, Netscape, ShareYourWorld, JumpStation…

Used any of these recently? Or even heard of them? Didn’t think so…

Rest in Peace, guys

If you’ve been to any startup talk, listened to any startup podcast or read a blog post from any of the Shoreditch craft-beer drinking bearded startup guys you will incessantly be reminded of the importance of being first to market.

This is diametrically opposed to the countless academic research papers, real world events and even logic itself. It seems that this ideology has stemmed from the Lean Startup, which has been interpreted by many to mean that in order to succeed it is imperative to be first to market with an MVP. This is not correct. I am not criticising the Lean Startup, I am criticising this hardline interpretation of it.

In this post I would like to dispel the myth that being first to market is imperative to success and explain what factors really determine first mover advantage and the benefits and drawbacks that come with it.

What is first mover advantage?

In a business context, any significant entity that is the first to enter a particular market segment is referred to as having first mover advantage, or FMA for short. If a business can successfully achieve FMA it can easily monopolise the market segment which can result in higher profit margins through control of supply. Companies like Hoover with their line of vacuum cleaners and Gillette with safety razors successfully capitalised on FMA in the early stages of their business.

First Mover Advantage Matrix

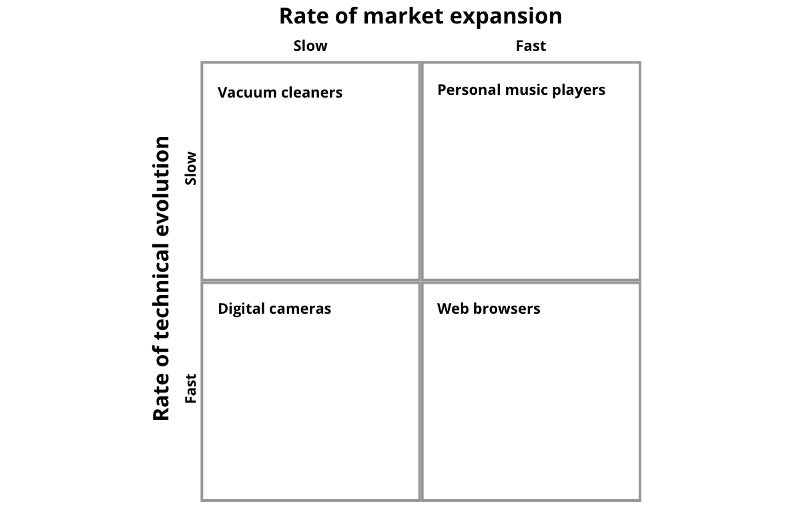

There are two predominant factors that will affect a business’s chance of FMA success; The rate of technical evolution and the rate of market expansion. These two factors can be transposed on to a matrix to create the FMA matrix. The position of a business in this matrix helps us to predict its chance of obtaining FMA and the duration it will be able to retain it.

Short-term and Long-term FMA

For all of the four types of market in the FMA matrix there are two possible types of FMA; short-term and long-term. Each will require different resources and yield different advantages. It’s important to know what kind of first mover advantage you are trying to obtain and its most likely outcomes (or in some cases, lack thereof).

Slow Evolution, Slow Expansion

A business that operates in an industry with slow technological evolution and slow market expansion (top left of the matrix) typically has the best chance of obtaining long lasting FMA. Hoover is a prime example of a business that has operated in these circumstances.

In 1908 janitor James Murray Spangler invented and began selling the Electric suction-sweeper. By 1921 the Hoover Suction Sweeper Co. had developed into a global business yet less than 5% of American households owned one. Gradual updates in the design like the addition of a container for the upright dust bag and the addition of the ‘beater bar’ were implemented as the market grew.

In this kind of environment Hoover had little trouble meeting demand or maintaining technical superiority. Consequently, any new entrant could not substantially differentiate itself and any innovations by such entrants could be incorporated by Hoover long before they could obtain any substantial market share.

In the short-term the benefits of being first into this kind of market will be almost non-existent. Providing you can hold onto your customer base and incorporate any new technological developments into your product, in the long-term being first will almost always pay off.

Fast Evolution, Slow Expansion

A business operating in an industry with a fast paced rate of technological evolution but a slow rate of market expansion (bottom left of the matrix) has an unlikely chance of obtaining any substantial FMA. This is because the fast pace of technological change inevitably results in new competitors with more technically advanced products entering the market space, rendering prior products obsolete.

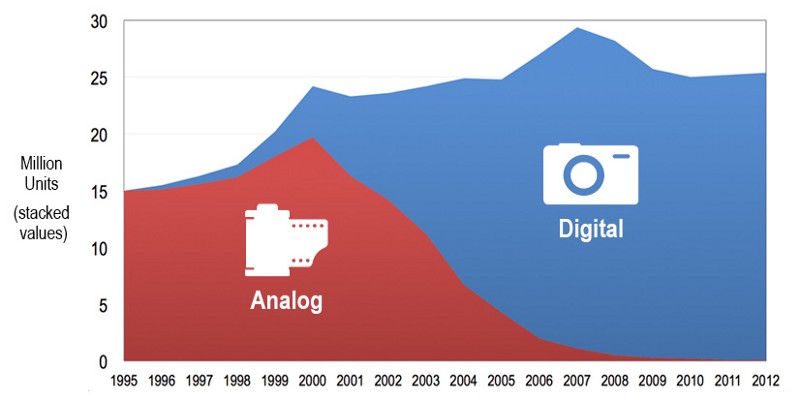

In 1981 Sony released the first commercial digital camera, the Sony Mavica. With its meagre 0.3 megapixel resolution it was not an instant game changer. In addition to this the furious pace of technological evolution made new products obsolete within a year. The biggest area of improvement was the image resolution. By the early 2000s high end digital cameras were capable of taking images up to 6.4 megapixels. Using its deep-pockets and its technological abilities, Sony managed to earn a commanding share of the digital camera market. Today, Sony is still a market leader with a 34.3% global market share.

Both short-term and long-term advantages are almost impossible to attain. Any new potential customers will be drawn to the most technologically advanced products and any new entrant will be able to substantially differentiate itself from the rest of the leading competition. Because of this, it’s often advantageous to wait until the rate of technological evolution decreases and the market begins to grow.

Slow Evolution, Fast Expansion

A business operating in these circumstances will require a strong brand, a scaleable production system and robust distribution network in order to obtain long-term FMA. Early entrants with less capacity for production and distribution should be able to retain its original customer base. Fortunately, these entrants can patent early technologies so that later entrants will have to pay licensing fees to remain in the market.

Consider personal music players, pioneered by Sony in 1979 with its revolutionary product The Walkman, the basic technical design remained unchanged for well over a decade. During this time, the market grew exponentially resulting in sales of over 40 million units. Relying on its marketing, design skills and strong brand Sony managed to maintain a market share of over 48%.

But this is not all of the story, in 2001 when the technology had already begun to shift from physical media to digital, Apple (a 22 year late entrant) took the market by storm with its equally revolutionary product, the iPod. Supported by beautiful music library management software and a frictionless music purchasing system, iTunes, Apple simultaneously revolutionised both music retail and consumption. Using the same strong resources as Sony did in the late 70s the iPod became the fastest selling mp3 player to ever hit the market selling over 350 million units in 15 years.

A first entrant without adequate resources will have to accept a short-term first mover advantage, however any early entrant should be able to hold onto its initial customer base. To have a long-term FMA you will need adequate marketing, production and distribution systems in place to achieve any long-term advantages.

Fast Evolution, Fast Expansion

In some cases, both technological change and market expansion are equally aggressive, in this situation any entrant wishing to obtain long-term FMA will require substantial resources to achieve any tangible advantage. As with all markets with quickly evolving technology new entrants can enter the market with a more technologically advanced product without the fear of cannibalising older products.

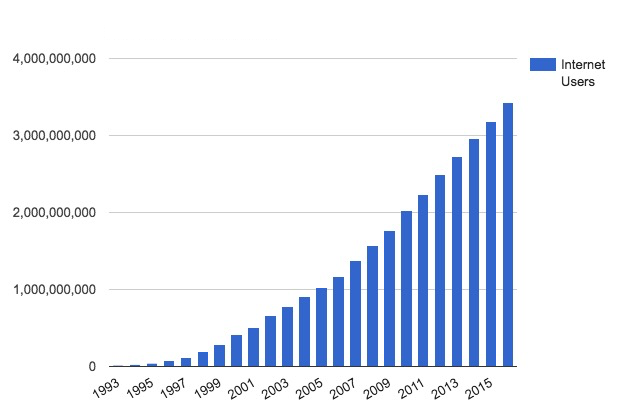

Netscape is a notable example of a business that suffered due to existing in a market with incredibly fast technological evolution. In 1994 the internet started to grow exponentially, almost doubling every year in the last half of the 1990’s. This incredible pace of growth enables later entrants like Microsoft to enter the market with a more advanced product, conveniently delivered within it’s operating system.

A short-term FMA is likely for an early entrant, but it is almost sure to be short lived. Unless you simultaneously have outstanding financial, production, distribution and R&D capabilities long-term FMA is extremely unlikely.

Have The Right Resources

Wherever you are on the FMA matrix you will need the right assets and resources. Typically in markets with fast technological evolution, you will need deep pockets for R&D to remain at the forefront of technology. However, in fast expanding markets you will need strong production, distribution and marketing facilities. The matrix below shows some of the key resources you will need for each of the market environments.

But do not take the possession of substantial resources as a guarantee of success. Execution is key. In fact Apple used IBM’s far superior assets against them branding themselves the rogue company for the people. This was the intent behind Apple’s iconic 1984 superbowl ad. See also “Was George Orwell right about 1984?”

It is now 1984. It appears IBM wants it all

Conclusion

Many factors will decide a businesses fate and timing is a big factor. However, the idea that the first business into a market segment will have the best chance of success simply isn’t true for the majority of cases.

In order to succeed you need to look at the state of the market, candidly scrutinise the assets you have at your disposal and decide what kind of FMA the market will allow you to obtain.

But don’t forget, once you’ve jumped into the water you only have one option. Swim.